Whole of life insurance – an advisers tale

Whole of Life Assurance – an Advisers tale

By : Reading Time 7 Minutes.

I’ve been insuring people’s lives for around twenty five years now.

When I started in the industry one of the most popular policy was Whole of Life. It gave clients the life cover they needed; it ran – as the name suggests – for the whole of their life – and it built up an investment value, so over time it gave both protection and savings.

But gradually, Whole of Life fell out of favour.

People were living longer – which meant that premiums for straightforward term assurance dropped significantly.

Suddenly, Whole of Life looked expensive – especially when the investment returns weren’t so good and the premiums had to go up.

As the internet boomed and online sales of life cover increased, price became almost the only criterion for buying life cover. Get the cover you need, forget about long term financial planning and the cheaper the better.

That was fine in the short term.

The problem was, that more evidence from clients showed that it didn’t work in the long term.

Over the years I saw hundreds of clients realise that they still needed life cover later in life.

Maybe they needed it to cover loans on their mortgages and debt.

Maybe they’d re-married and had a second family.

Maybe they wanted to protect their estate against inheritance tax.

There were as many different reasons as there were clients. But they all had one thing in common – the life cover they needed was now expensive. Or even worse, it was impossible to obtain because their health had changed.

Maybe what they’d needed all along was Whole of Life…

In fact, maybe what we all need is Whole of Life – because Whole of Life has changed dramatically.

-

Premiums on Whole of Life have dropped significantly over the years and they are now guaranteed to remain constant for the whole of your life. It doesn’t matter how old you get, your premiums will never change and you will always have life cover

-

The investment element of Whole of Life – and the variable returns that made it so difficult to plan – has gone. Instead there are now guaranteed sums assured that you can rely on.

-

This means that Whole of Life can now address a variety of financial planning needs. It can give you choice, flexibility and control.

And there are five very good reasons why a properly designed whole of life insurance policy might well be the answer to your financial planning needs:

Whole of Life can offer great value for money For many customers term life insurance can appear to be a waste of money as they don’t (of course) intend to die during the term. Whole of Life is fundamentally different as it will eventually pay-out.

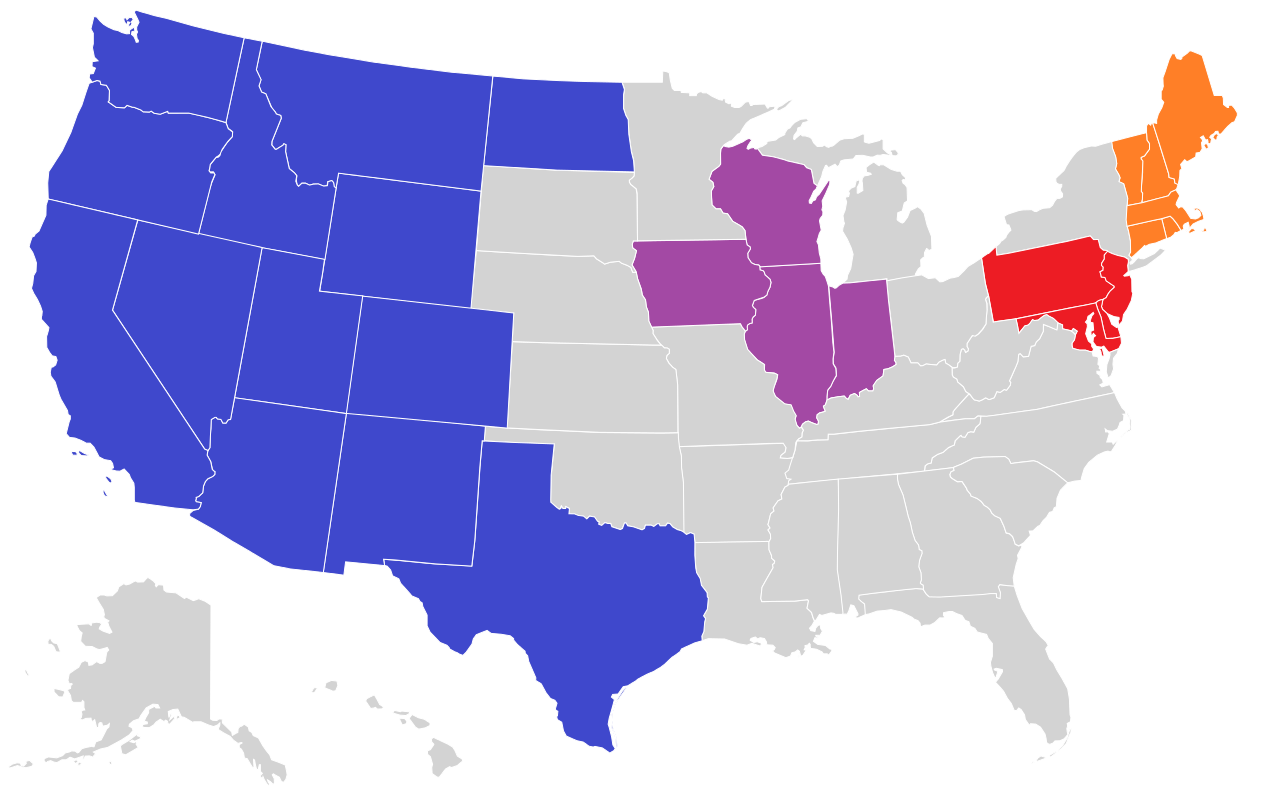

Quotations based on level cover for males and assume standard terms - source Assure web 7th May 2017

Whole of Life secures your family’s inheritance Whole of Life is guaranteed to pay out when you eventually die: the ‘term’ can never run out. So you can rest assured that your family’s inheritance is secure. It doesn’t matter what happens to your investments: it doesn’t matter what happens to property prices – a Whole of Life policy provides a known and guaranteed inheritance for your family.

Whole of Life can make all the difference to your retirement planning The new pensions rules have given everyone a lot more choice and flexibility – unless you eventually want to leave your pension ‘pot’ to your beneficiaries. That would mean you couldn’t spend it during your lifetime – and that’s where Whole of Life comes in. By providing a guaranteed inheritance Whole of Life means you have far more flexibility as to how your take your pension benefits: you no longer have to worry about your pension providing an inheritance for your family.

Whole of Life protects the family home Many people plan to pass their family home on to their children – but end up being unable to do so as they’ve had to use the house to top-up their retirement income. That’s not a problem when there’s a Whole of Life policy in place to provide a guaranteed inheritance for your family. You get the income you need in retirement: your family receive the inheritance you’ve always been determined to leave them.

A Whole of Life policy will live as long as you do… Sadly, we’re all going to die one day. The problem is none of us knows when that will be. And if you still need life cover – for any of the reasons we’ve outlined above – Whole of Life is a sensible solution.

It’s the only type of policy guaranteed to be always in force: it’s the only type of policy where an insurance company can’t say, “We’re sorry, you’re too old.” Or where you have to tell your family, “I’m sorry, I can’t afford the cover any more.”

None of us know what’s round the corner or contemplate our own mortality – but a Whole of Life policy will cope with whatever life throws at you. It provides guaranteed protection: it can protect your family, protect your business; protect your inheritance and play a crucial part in your retirement planning.

So what are the disadvantages?

Whole of life cover will be more expensive than term insurance that pays out during a set term. These must be weighed up when shopping around for the right life cover for you and your dependants.

Retirement usually brings to mind for many people the thoughts of liberation from work, from responsibility, from routine and from permanent. Planning for death may may not be in the plan, but should it.

For increasing numbers of clients, Whole of Life should be considered as the cornerstone of their financial planning, or at the very least a hybrid of cover alongside their term insurance.

To see how Whole of Life could work for you, please don’t hesitate to get in touch with us. We’re happy to listen, and to help.

Warmest Regards

Sam

Comments are closed.

Get Social

RSS

Twitter